India Faces Looming Copper Shortage Amid Quality Control Norms

Introduction

India is facing a potential copper shortage as new quality control regulations, which came into effect on December 1, 2024, are causing delays in certification for copper suppliers. With Japan being the dominant supplier, providing 80% of India’s copper imports, the backlog in certification is threatening to disrupt copper availability for industries across the nation.

India’s Dependence on Copper Imports

Copper is a critical raw material for India’s growing infrastructure and manufacturing sectors.

- Import Dependency: India relies on imports for 30-40% of its refined copper, with Japan as the primary source.

- Import Value: In the financial year 2023-24, India spent ₹16,500 crore on importing refined copper, underlining its significance in key sectors.

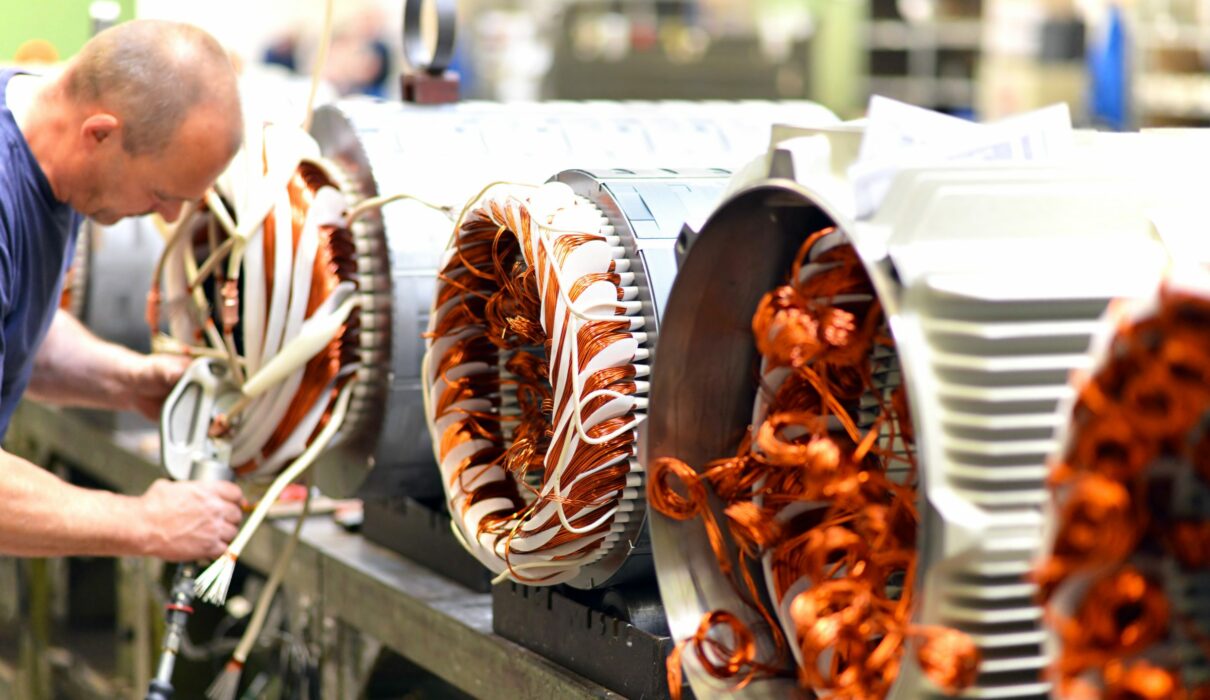

- Key Applications: Copper is essential in electrical cables, power transmission, construction, and electronic manufacturing.

Quality Control Regulations: Disrupting Copper Imports

The enforcement of new quality control standards for refined copper is resulting in a supply crunch.

- Certification Delays: Japanese suppliers, who account for a significant portion of India’s copper imports, are still awaiting certification, causing a delay in shipments.

- Shortage Duration: Experts predict the shortage could persist for up to three months, with the potential for longer disruptions.

- Supply Chain Strain: The copper shortage will strain industries reliant on timely delivery, particularly the electrical and electronics sectors.

Challenges in Domestic Copper Production

India’s domestic copper production is not enough to meet the growing demand, leaving the country reliant on imports.

- Limited Production Capacity: India produces only around 60% of the copper it needs domestically.

- Increased Demand: The demand for copper is rising as India’s power, electronics, and infrastructure sectors continue to grow.

- Dependence on Imports: With local production unable to meet domestic demand, the country remains dependent on imports to fill the gap.

Impacts of Copper Shortage on Industries

The copper shortage is expected to affect several critical sectors in India.

- Electrical Manufacturing: The delay in copper imports will cause production delays in the electrical manufacturing industry, which relies heavily on copper for wiring and cables.

- Price Hike: The limited supply is likely to push copper prices higher, further increasing production costs across various industries.

- Project Delays: The construction and infrastructure sectors may also experience delays, especially in power transmission projects.

Industry’s Call for Urgent Action

With the threat of a prolonged copper shortage, industry leaders are urging the government to take immediate action.

- Expediting Certification: Manufacturers and suppliers are calling for the swift certification of imported copper to restore the supply chain.

- Diversifying Copper Sources: There are calls for India to diversify its sources of copper to reduce reliance on a single supplier like Japan.

- Increasing Domestic Production: Experts recommend investing in domestic copper production to reduce future dependence on imports and mitigate supply risks.

Potential Long-Term Solutions for India’s Copper Crisis

To avoid recurring copper shortages, India needs to consider several long-term solutions.

- Boosting Domestic Production: Encouraging the growth of domestic copper production will help alleviate future supply concerns.

- Strategic Stockpiling: India could create a strategic reserve of copper to ensure the country is better prepared for potential disruptions in the future.

- Improved Import Strategies: Developing stronger relationships with multiple copper suppliers worldwide can reduce the risks associated with over-reliance on a single country.

India is facing a significant copper shortage due to delays in certification caused by new quality control regulations, particularly affecting imports from Japan. This disruption is expected to last up to three months and could have far-reaching consequences for industries reliant on copper. Immediate government intervention is crucial to expedite certification processes and explore long-term solutions to secure a steady copper supply in the future.